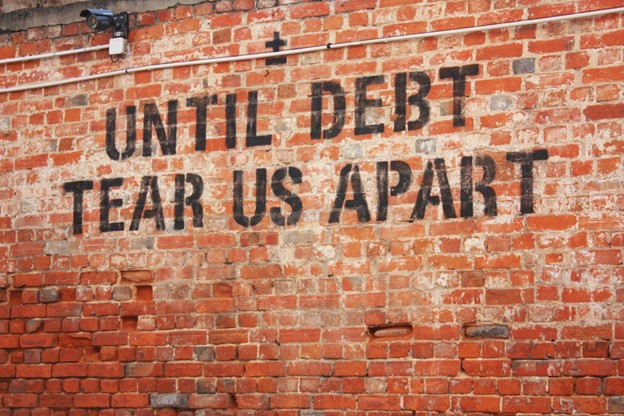

Debt can feel like a current, pushing you further from financial stability. Credit card bills, student loans or medical expenses, whatever it may be, can quickly lead to overwhelming amounts of debt that seem unmanageable. But anyone can learn what are their triggers and implement solutions that prevent their finances from sinking like the Titanic.

The Debt Trap: Understanding How It Happens

Life can be scattered with temptations to spend, often leading to people unwittingly falling into debt. Credit is easily available, advertisements entice shoppers into living beyond their means, and societal expectations push people in this direction too. And when you add unexpected emergencies or economic downturns, your debt can quickly spiral out of control.

Recognising these common pitfalls is important to avoiding them. People often use borrowed money to cover budget gaps. But what they don’t think about it is that the interest and late fees can quickly turn a small debt into an enormous financial burden that seems impossible to stop. That is true, if you don’t have proper planning and a clear strategy in place.

Tackling Debt Strategically: Snowball or Avalanche Approach

When it comes to debt repayment strategies, choosing the right approach can make all the difference. Two popular repayment methods are the snowball and avalanche approaches. The snowball method is about paying off smaller debts first to build momentum and motivation as you score quick victories. This approach can be especially effective for those in need of psychological boosts to remain on course with their financial plans.

On the other hand, the avalanche method prioritizes debts with high interest rates first, saving you money over time through reduced interest payments. Although this strategy may take longer to show results, it can be more cost-efficient in terms of reduced interest payments.

Avoid the Sinkhole of Minimum Payments

Minimum payments may seem like an easy solution, but in reality they can do more harm than good. Making only minimum payments extends the length of time it takes to repay the debt while incurring significantly more in interest over time. Treat minimum payments as minimum requirements and pay extra when possible in order to reduce the principal balance faster.

Get Professional Advice When Necessary

At times, debt can feel like a losing battle despite your best efforts. Financial advisors, credit counselors or debt consolidation services can give you tailored solutions and negotiate with creditors on your behalf.

While getting help is never shameful or embarrassing, make sure to choose only reputable organisations to avoid scams. These professionals can go through the debt management plan pros and cons and recommend the best course of action for your specific situation.

Conclusion

Debt doesn’t have to spell out your financial disaster. When you are able to understand how debt accumulates, develop an affordable budget, and use effective repayment strategies, the path toward financial independence can become more clear.

Taking control isn’t about making huge gestures. Rather it involves small, deliberate steps designed to replace the chaos of drowning in debt with the stability of financial security. Going through the steps of getting out of debt takes commitment, patience, and an ambitious mindset.

This is a guest blog from Fatjoe Publishing.

Read our blog about financial management as part of our work-life balance series